An intelligent app to Know, Grow, and Protect your wealth & legacy.

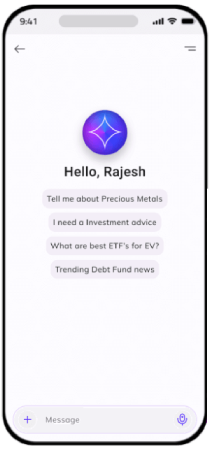

Your intelligent assistant to simplify financial jargon, compare options, and brainstorm investment ideas.

Business & Marketing

Business & Marketing

Engineering

Engineering

Product & Strategy

Product & Strategy

Business & Marketing

Business & Marketing

Engineering

Engineering

Product & Strategy

Product & Strategy

So we built Famli to bring that hope to every household—an easy, thoughtful way for families to understand their wealth, protect their future, and grow with intention.

We’ve lived those moments too—learning through mistakes and wishing someone had shown us the way.

FAMLI exists to rewrite that story. To make financial planning intuitive, not intimidating.

No spam, ever. We respect your privacy and will only send updates about Famli.

Comprehensive Platform

Manage all aspects of client wealth – investments, tax, insurance, and legacy – in one place

Enhanced Client Engagement

Provide holistic financial view that keeps investors committed long-term

Employee Financial Wellness

Offer comprehensive wealth management as a premium benefit that attracts and retains top talent

Integrated Planning Approach

Position insurance within complete family wealth strategies, not as standalone products

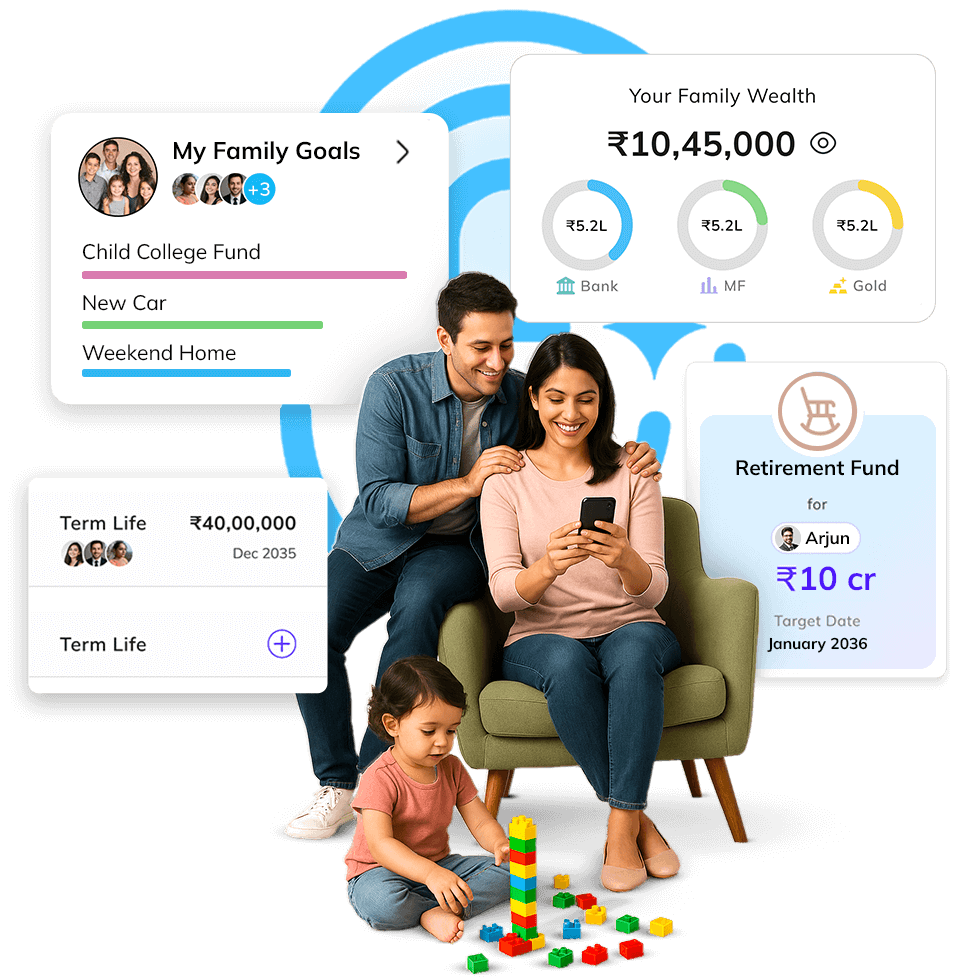

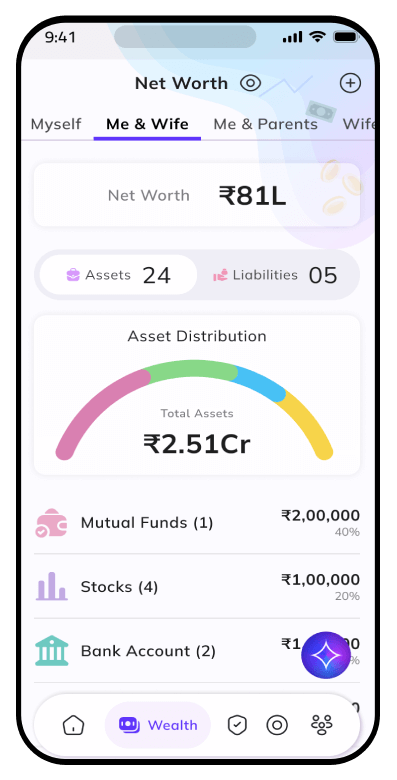

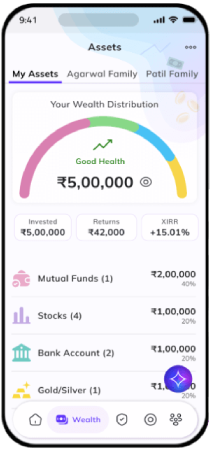

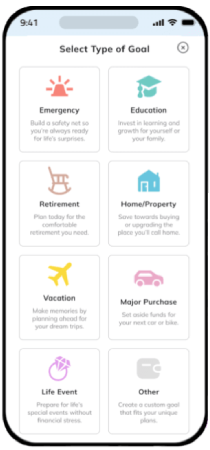

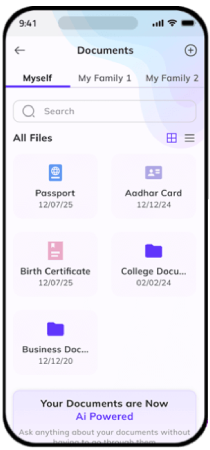

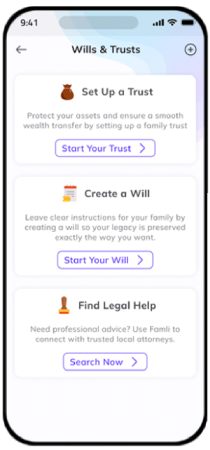

Famli is a smart, family-centric app that helps you understand, grow, and protect your wealth and legacy - all in one place.

Famli is designed for individuals and families looking for a simple, collaborative way to manage their finances, investments, taxes, succession, and legacy planning, regardless of age or income.

Famli does not provide execution-level advice; instead, it offers research, insights, and planning support based on your goals and risk profile.

No - while you can link accounts via account aggregators for convenience, you can also enter values manually or upload documents.

Yes, we use bank-grade encryption, follow data privacy laws, and store all information securely.

Yes, you can delete your profile and associated data at any time from the app settings.

Only you and the family members or advisors you explicitly choose to share with.

It depends on the data provided - linked accounts stay up to date, while manual entries should be reviewed regularly.

We recommend reviewing and updating manual entries once a month or whenever there’s a major change.

You can use current market rates or our built-in valuation tools for an estimated value.

Yes, you can add home loans, credit cards, or any other EMIs and track their outstanding amounts.

Yes, you can label holdings as joint or HUF and assign visibility to relevant family members.

Absolutely - NRIs can use Famli to manage and collaborate on India-based or global financial information.

Not necessarily - Famli complements your existing advisors by organizing your data and surfacing smart insights.

Not yet, Famli is available as a native mobile app today but in future we will also launch a web app for easy access across devices.

You can use the in-app feedback option or email us directly at support@famli.life

Famli is free during our early access period—paid plans with premium features will be introduced later.

We plan to offer premium subscriptions, advisory partnerships, and integrated product discovery in the future.

Upcoming features include investment recommendations, insurance planning, estate tools, and an AI-powered Research Buddy.

A family office is a setup used by wealthy families to manage investments, taxes, succession, and legacy planning.

Famli offers the same holistic, long-term planning mindset—powered by AI and accessible to every family, not just the ultra-wealthy.

Not at all—Famli is built for any family that wants to take control of their finances, no matter the size of their portfolio.

Copyright © 2025 FAMLI TECHNOLOGY PRODUCTS PRIVATE LIMITED